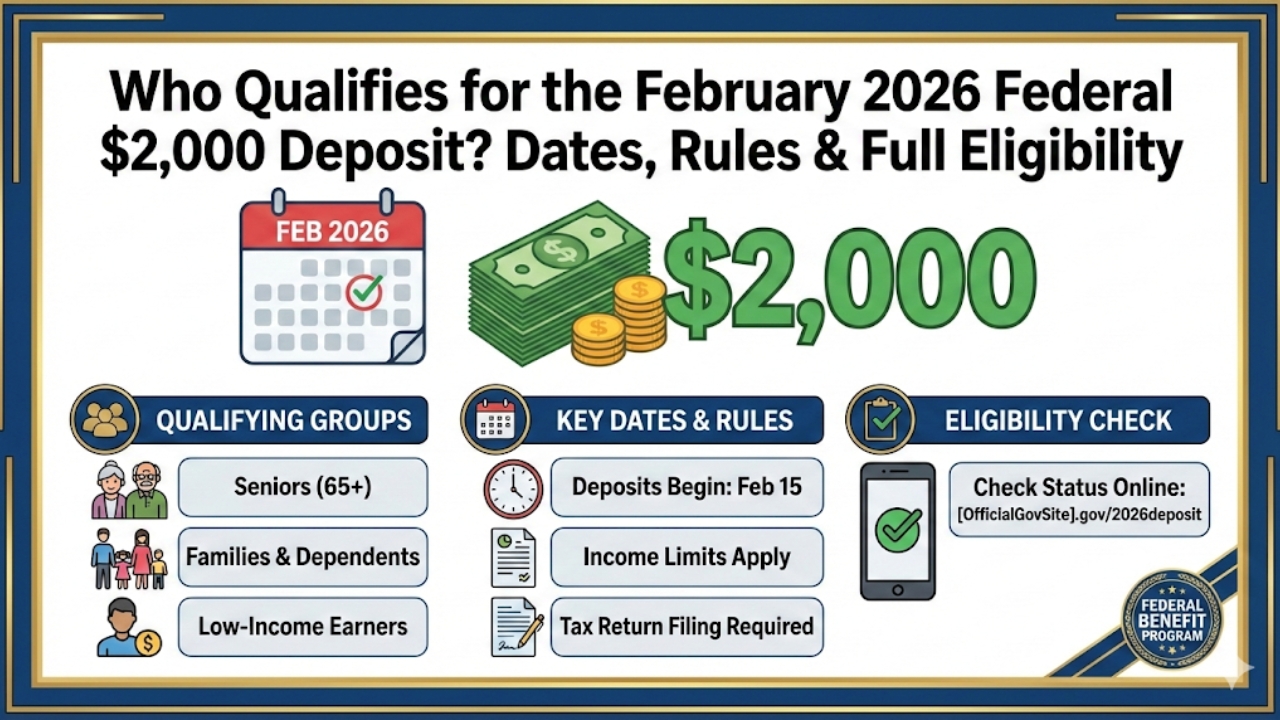

Millions of Americans are buzzing about a potential $2,000 federal deposit hitting bank accounts in February 2026. This one-time payment aims to ease financial strains from rising living costs, but strict rules determine who gets it.

Understanding the Payment Basics

The federal $2,000 deposit stems from recent economic relief efforts under President Trump’s administration. Launched as targeted support, it builds on past stimulus models but focuses on middle-income households facing seasonal expenses like winter heating and tax prep. Funds come via the IRS, prioritizing direct deposits for speed.

Unlike tax refunds, this isn’t tied to your 2025 earnings directly. Instead, it uses 2024 and 2025 tax data for quick rollout. Expect payments in waves starting early February, wrapping by month’s end, to manage processing loads.

Core Eligibility Rules

Qualification hinges on income thresholds from your latest IRS filings. Single filers with adjusted gross income up to $75,000 snag the full $2,000, while married couples filing jointly qualify up to $150,000. Above those lines, benefits phase out gradually—dropping by 5% per $1,000 over the limit—until fully gone at $95,000 for singles and $185,000 for couples.

You need a valid Social Security number and half-year U.S. residency in 2025. Non-citizens with work permits may apply if they filed taxes. Households with kids or dependents often see boosts, adding $500 per qualifying child under 17, mirroring child tax credit logic.

Key Dates and Timeline

Mark your calendar: IRS evaluations kick off January 15, 2026, using e-filed or paper returns postmarked by October 2025. First deposits drop February 3 for direct deposit users with updated banking info. Paper checks follow mid-month for others.

Late filers or info updaters get pushed to late February or March. The window closes April 15, 2026—file now if you haven’t. Track status via IRS “Where’s My Refund?” tool or your online account.

Income and Household Factors

| Filing Status | Full Amount Threshold | Phase-Out Starts | Phase-Out Ends | Extra for Dependents |

|---|---|---|---|---|

| Single | $75,000 | $76,000 | $95,000 | $500 per child |

| Married Joint | $150,000 | $151,000 | $185,000 | $500 per child |

| Head of Household | $112,500 | $113,500 | $140,000 | $500 per child |

This table breaks down limits clearly. Note exclusions: incarcerated individuals, some welfare recipients, and those with unpaid back taxes over $10,000 don’t qualify. Incarceration wipes eligibility entirely.

Exclusions and Common Pitfalls

Watch out for traps. If your bank details changed since last year’s return, update via IRS.gov or Form 8888. Non-filers must submit a simple registration by February 15— no SSN? You’re out. Also, this payment counts as taxable income next year, so budget accordingly.

Fraud alerts abound: ignore scam sites demanding fees to “claim” funds. Official notices come by mail or IRS app only. Double-check via irs.gov for real updates.

How to Maximize Your Chances

File early if pending. Update direct deposit info pronto—over 80% get funds fastest this way. Families, verify dependent SSNs match records. Low-income folks near thresholds might qualify via earned income credit interactions boosting effective income fits.

Consult a tax pro if borderline. Community centers offer free help through VITA programs nationwide.

What Happens After Payment

Once deposited, funds are yours—no repayment. Use wisely for essentials; it’s not a loan. Future rounds? Possible if inflation persists, but nothing confirmed beyond 2026. This initiative tests targeted aid’s impact on consumer spending without sparking inflation.

Stay vigilant on IRS announcements as details evolve.

FAQs

When do deposits start?

First wave: February 3, 2026, for direct deposit filers.

Do I need to apply?

No—automatic if eligible via recent tax filings.

Is it taxable?

Yes, report on 2026 taxes.

Disclaimer

The content is intended for informational purposes only. You can check the official sources; our aim is to provide accurate information to all users.